Why do I keep going on about the US equity allocations in portfolios?

Because I think it is one of the most important decisions investors will make for the next 10 years, for their equity allocation.

Do you back an index (holding 65-70% US stocks) or the data?

The data says:

Concentration of top 10 stocks in US = 41%

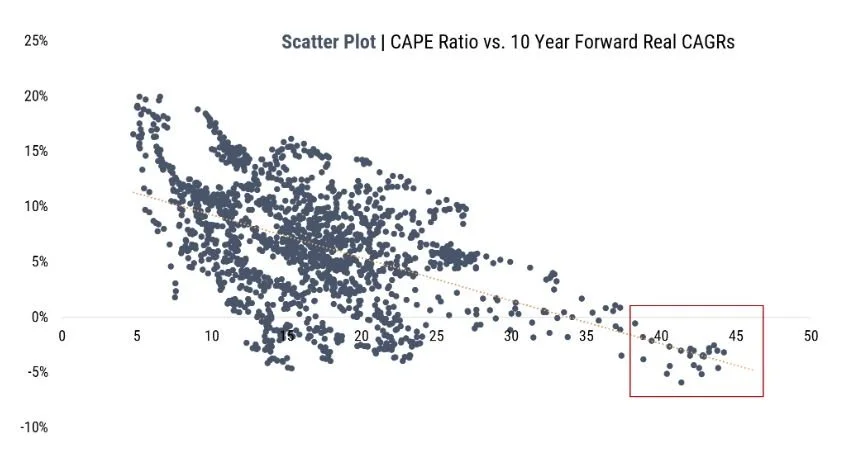

Valuation (CAPE) of the overall US market = 41x

Both of these are at or near all time (100 year) highs, and roughly DOUBLE long term average.

On their own, high concentration and high valuations are bad = historically poor/negative forward 10 year returns. Together, horrible. Also, both of these factors come with higher volatility.

Let's add in current profit margin into the mix - at another near all time high.

The result:

1. High valuations + profit disappointment = sharp de-rating. If margins weaken or earnings revisions turn negative, valuations have a lot of room to fall.

2. Concentration amplifies everything. If one or two mega-cap names miss earnings or guide lower, the index can drop rapidly, pulling the broader market with it.

It boggles my mind why a UK investor would opt to have 65% in this. And I haven't even brought currency exposure into the equation.

There's an easy solution:

- More balanced geographic weighting

- More balanced currency allocation

- More balanced cap weighting

- More balanced style skew

Diversify - simply, cheaply and sensibly. It's a lot more relaxing and you have maths on your side.