Gold is no longer behaving like a hedge. It is behaving like a reserve asset being repriced.

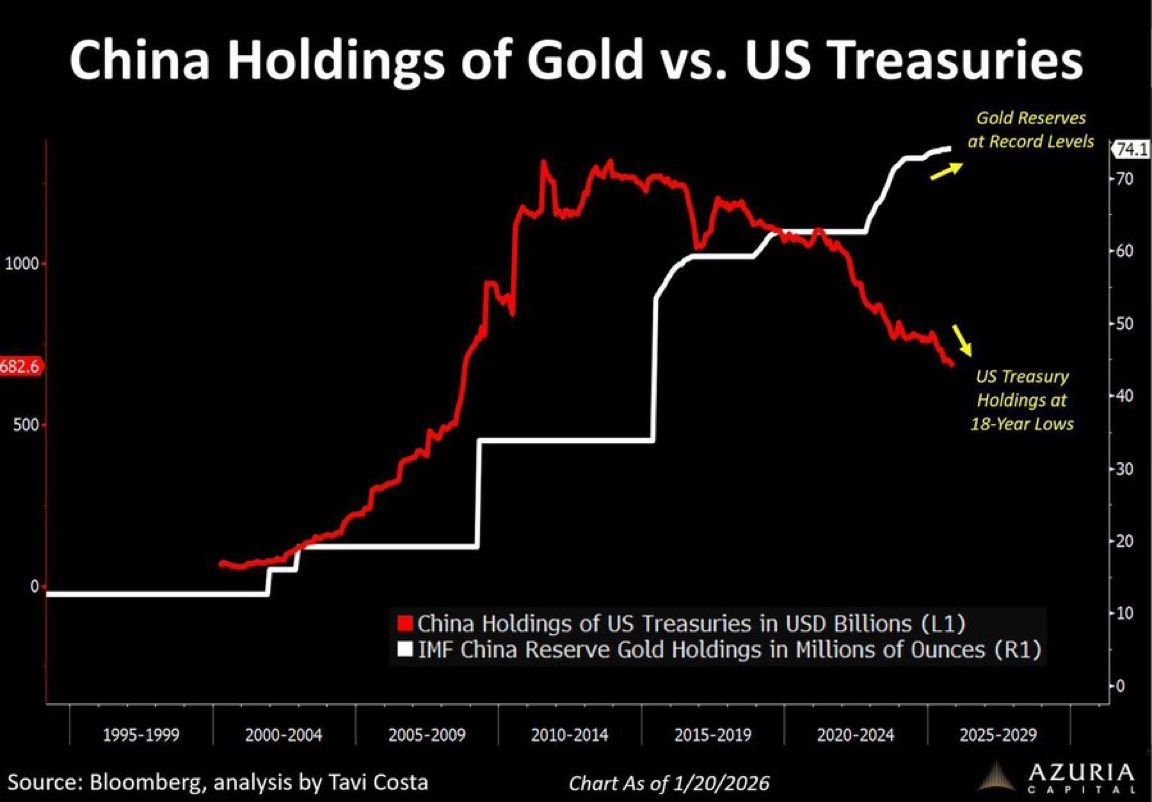

The first chart shows a structural shift, not a tactical one. China has been steadily reducing its holdings of US Treasuries while simultaneously accumulating gold to record levels. This is not about yields or short-term returns. It is about balance-sheet resilience. Treasuries are liquid, but politically encumbered. Gold is inert, but sanction-proof. For large reserve holders operating in a fragmented geopolitical environment, that trade-off now matters more than carry.

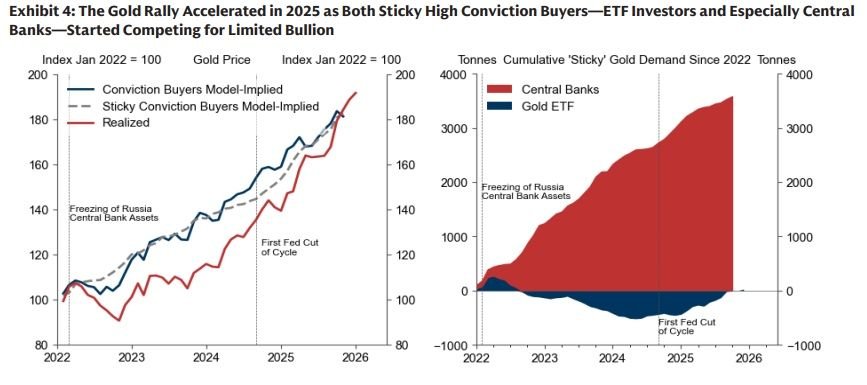

The second chart explains why price dynamics have changed. Since 2022, gold demand has been driven by “sticky” buyers: central banks first, ETFs later. Once central banks step in as persistent accumulators, supply elasticity disappears. Bullion markets are shallow relative to the size of sovereign balance sheets, so incremental buying forces prices to clear higher. ETFs then compete for the same limited float, amplifying the move.

This is why gold rallies now look different from past cycles. They are less about fear and more about strategy. When reserve managers start treating gold as monetary insurance rather than an alternative asset, price becomes secondary to availability. And when that happens, gold does not mean-revert easily. It resets.