When Valuations Reach Extremes, Markets Don’t End; They Change

Markets rarely announce turning points. More often, they leave traces.

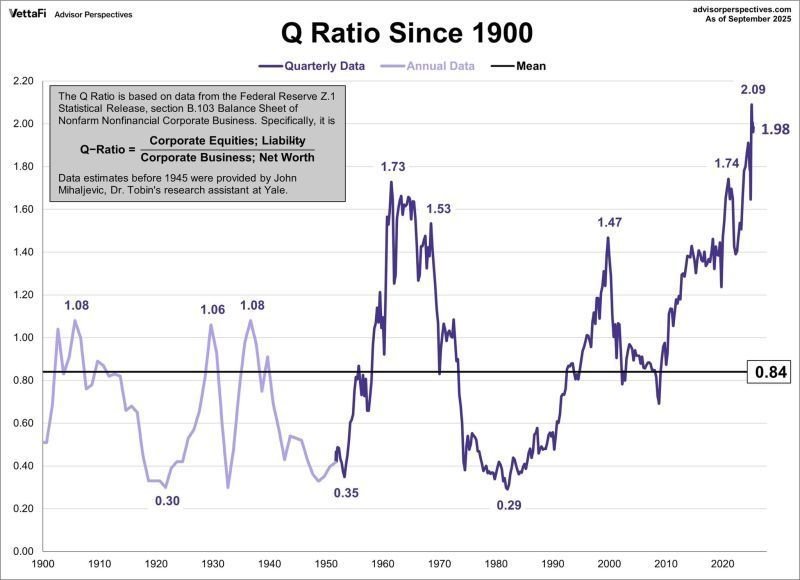

One of the most persistent is Tobin’s Q Ratio. As of September 2025, it stands just under 2.0, roughly 2.4 times its long-term average of 0.84. In more than a century of data, valuations have only reached this territory a handful of times.

What makes the Q Ratio useful is not its ability to time market peaks, but its ability to identify regime conditions. It captures long stretches where expectations drift far from underlying economic replacement costs, and where investor behaviour becomes increasingly shaped by confidence rather than margin of safety.

History offers perspective.

When the ratio climbed above 1.7 in the late 1960s, markets spent much of the following decade oscillating violently, delivering poor real returns despite repeated rallies. When it surged toward 2.0 around the turn of the millennium, it reflected a period where capital chased narrative faster than fundamentals could absorb it. More recently, the post-pandemic peak near 2.1 marked the culmination of an era defined by zero rates and abundant liquidity.

Today’s environment is different, but not calmer.

Valuations remain elevated, yet the macro backdrop has shifted. Fiscal dominance is playing a larger role in shaping monetary outcomes. Inflation pressures are more persistent. And central banks face growing incentives to ease policy even as price stability remains fragile. The combination is less reminiscent of the late 1990s than of the 1970s, a decade defined not by a single collapse, but by repeated reversals, sharp drawdowns, and long periods of frustration for passive investors.

That does not mean opportunity disappears.

It means it changes form.

Periods marked by valuation extremes tend to produce more volatility, not fewer opportunities. History shows that some of the most durable fortunes were built during environments that felt unstable, uncomfortable, and unforgiving to consensus positioning. Volatility punishes complacency, but it rewards preparation, discipline, and historical awareness.

The Q Ratio does not tell investors what will happen next. It reminds us of the conditions we are operating in, and why risk management, flexibility, and patience matter more as expectations stretch further from long-term norms.