If the US-UK trade negotiation sets a precedent, and all tariffs go to 10% ex-China, it’s still troubling for S&P 500 profits, underscoring the importance of a fruitful negotiation this weekend. In 2024, the index posted a gross margin of 35.3% when excluding financials, real estate, utilities, energy and transport companies. Based on the 43.2% of the cost of goods from overseas that we calculate, gross margin may fall as low as 30% if all trade partners are tariffed at 10% and China’s tariff remains above 100%. This translates to a potential earnings drop of 6% this year.

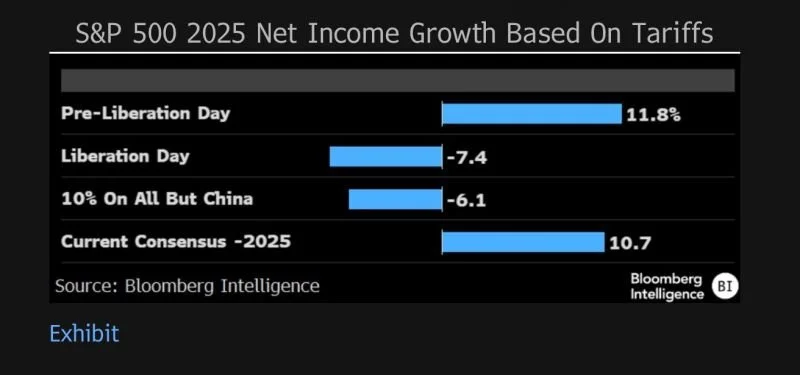

Prior to April 2, consensus expected 11.8% growth in 2025. That's now down to 10.7% - but is still a far cry from likely if tariffs remain the new status quo.