The "Smart Money" is leaving the party.

I usually try to avoid the "B-word" (Bubble). We all know that timing the market is next to impossible - prices can stay irrational far longer than short sellers can stay solvent.

But I just finished reading the December Quarterly Review from the Bank for International Settlements (BIS), and one specific data point stopped me in my tracks.

For the first time in 50 years, we are seeing "explosive behavior" signals in US Equities and Gold simultaneously. But the price isn't the scary part. It’s the participants.

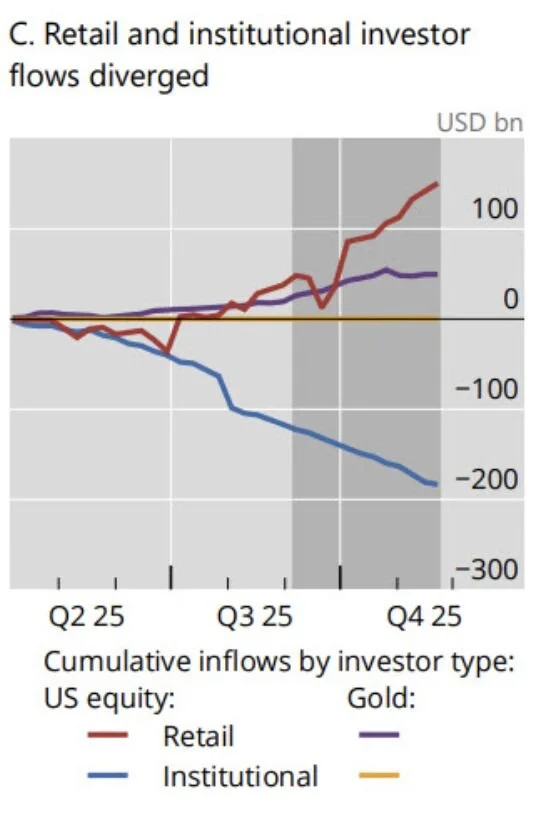

Here is the reality of the current rally: The data shows a massive divergence in who is buying versus who is selling:

👉 Retail Investors are pouring capital in, chasing trends and driving the premiums on ETFs. 👉 Institutional Investors are pulling back, either moving to cash or flattening their positions.

Why does this matter?

When a market rally is sustained almost entirely by retail sentiment (which tends to be herd-like) while the "smart money" heads for the exit, the structure of the market becomes incredibly fragile.

We can’t predict when a correction will happen. But the risk of a bubble burst has undeniably increased because the stabilizing floor of institutional capital is being removed.

If you are managing risk right now, this historic anomaly is worth paying attention to.