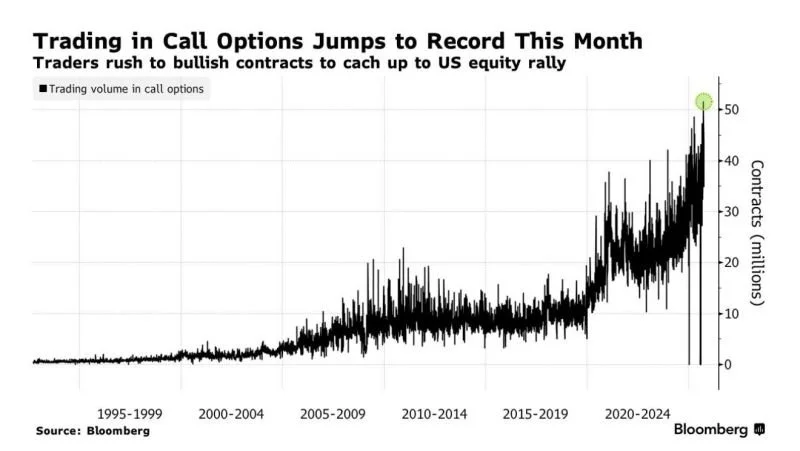

The explosive growth in US call option trading is more than a reflection of bullish sentiment—it’s a major source of systemic risk in today’s market.

As the chart shows, call options volumes have surged to record highs, amplifying market exposure and leverage across both institutional and retail investors. This rush intensifies market volatility, making sharp moves more frequent and market structures more fragile—especially when concentrated speculative positions unwind suddenly or liquidity becomes strained.

When options trading far outpaces changes in underlying equity supply, contagion risk grows and even “routine” pullbacks can cascade into destabilizing events. The concentration of risk, the speed of transactions, and the sheer size of leveraged bets all contribute to higher systemic vulnerability.

The new wave of option-driven speculation isn’t just changing how investors access the market—it’s reshaping the risk environment itself.