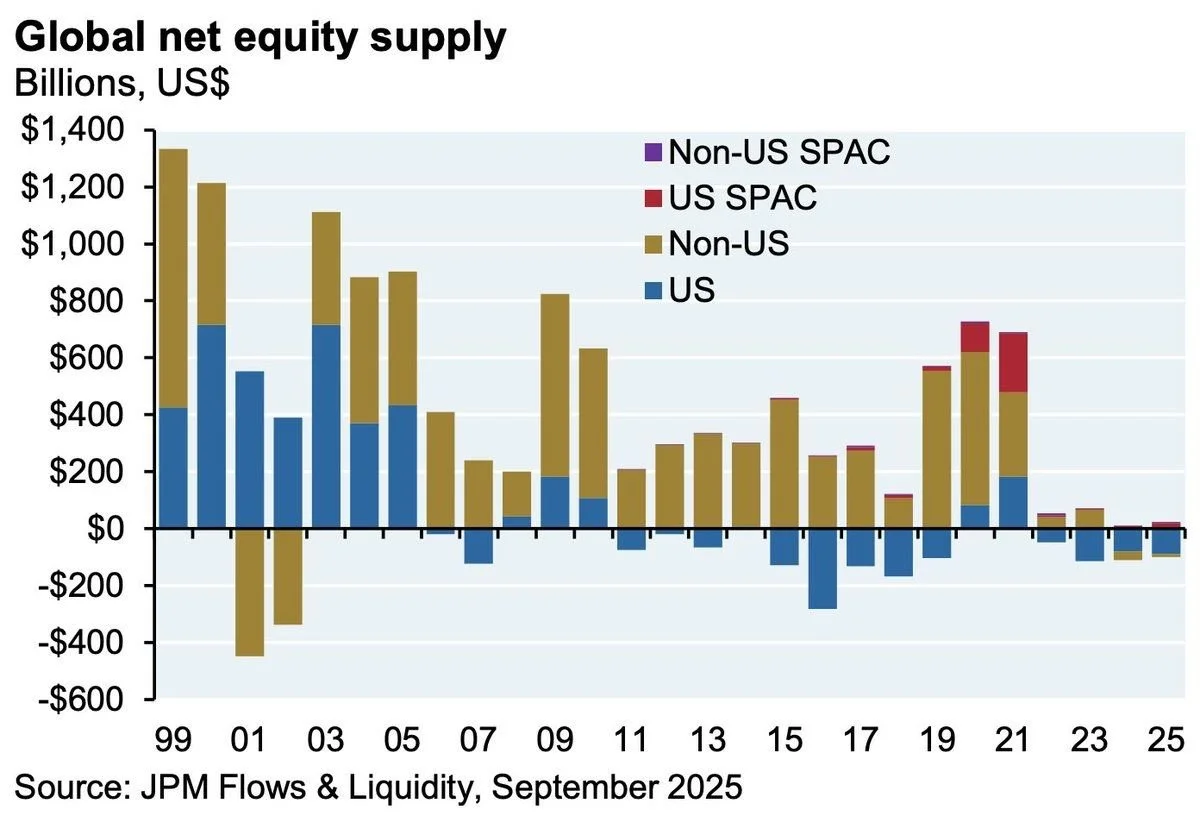

The story behind global equity supply explains more than just market flows—it helps reveal the roots of today’s Mag7 dominance.

As the chart illustrates, net equity supply has collapsed over the past decade, driven by fewer IPOs, persistent buybacks, and little new capital formation. With less fresh equity coming to market, investor capital funnels into existing leaders—concentrating both returns and risk in a handful of mega-cap names. This supply scarcity is a key reason Mag7 stocks have become such outsized drivers of index performance. All this despite the US economy being flushed with liquidity and cash, with the M2 at historic highs.

In today’s market, the combination of limited equity supply and high demand for scale has fueled one of the most pronounced episodes of concentration in market history. The Mag7 effect is a byproduct of this era of shrinking opportunity and intensified capital allocation.