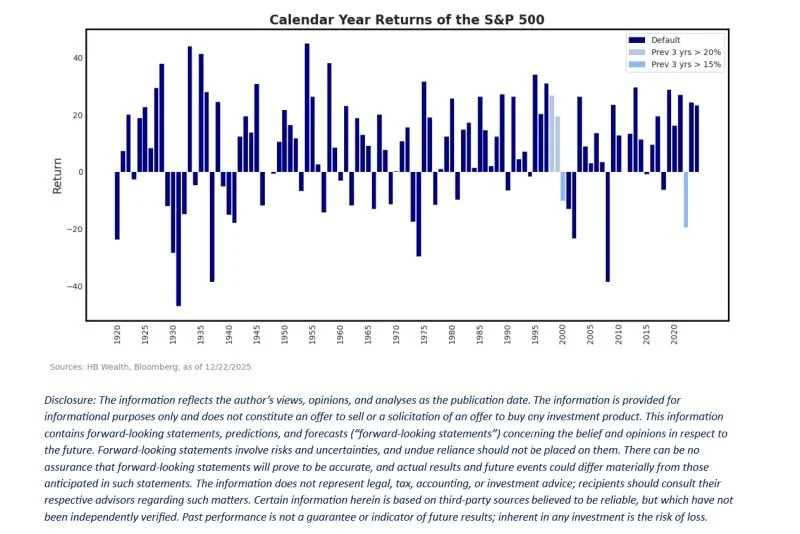

The S&P 500 is on pace for a third consecutive year of more than 15% price growth, and if a Santa Claus rally takes shape in the final trading days of the year, it could hit rare air with a third straight year of 20% growth. There is little historical precedent for extreme moves such as that which has just occurred in equity markets. Stocks have recorded three straight years of 15% just twice since the early 1920s – in the late 1990s and surrounding the pandemic – and three straight years of 20% growth occurred only during the tech bubble. After the 15%+ occurrences, the average gain in the 4th year was 4.2%, with stocks up 19.5% that following year in the 90s but down 19.4% in 2022.